Marijuana Business Formation: LLC or S-Corp?

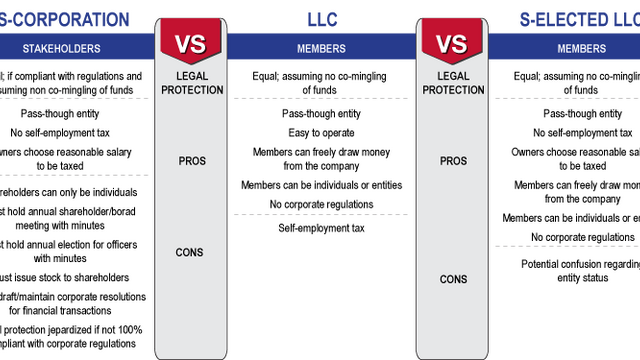

When you decide to launch a new business, you face many difficult decisions. Choosing a corporate entity is often one of them. Many people choose an Oregon limited liability company (“LLC”) almost by default. LLCs are easy to set up on the Oregon Secretary of State website at little cost. You should be aware though, that there can be some key advantages to forming an S-Corporation instead of an LLC.

One of these advantages can be tax savings. Members of the LLC pay Self-Employment (“SE”) tax at rate of 15.3% for Schedule C filers, while stockholders of an S-Corporations pay FICA taxes at the same 15.3% rate. While named differently, SE tax and FICA tax are both social security and Medicare taxes. So, for example, let’s say a certain LLC realized a net profit of $100,000.00 after its first year of business. The member or members would pay an SE tax on the entire net profit, or $15,300 in SE tax. If the same company was an S-Corp, the owner could choose to pay himself a “reasonable salary” of $75,000.00, which would result in a FICA tax of $11,475. The result is that the owners of the S-Corp pay $3,825.00 less in social security and Medicare taxes than the owners of the LLC on the same net profit.

Many marijuana businesses are choosing to form C-Corporations, which will be discussed in a future blog.

Our attorneys can assist you in choosing the corporate structure that is best for your marijuana business. Do not hesitate to contact our office to discuss these important decisions.

This Blog/Web Site is made available by the lawyer or law firm publisher for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By using this blog site you understand that there is no attorney client relationship between you and the Blog/Web Site publisher. The Blog/Web Site should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.

In addition, marijuana remains a federally illegal Class I drug. All activities related to marijuana are currently illegal under the federal laws of the United States and nothing contained on this Blog/Web Site is intended to assist in any way with violation of applicable law.